Are you considering investing in a self-invested personal pension (SIPP)? Read our comprehensive ii SIPP review and see how it compares with other options.

Key Takeaways:

- Interactive Investor (ii) is the UK’s largest flat-fee-based investing platform..

- The platform offers a range of investment accounts, including SIPPs and ISAs, and you can invest in both funds and shares.

- Interactive Investor has low annual fees compared to competitors (some of the lowest on the market for SIPPs.

- 24/7 customer support is provided.

- Charting tools and research / guides are limited compared to some providers

- You can use our SIPP fee calculator below to compare the charges against other providers

The only SIPP provider cheaper than ii across the board is Freetrade – but with Freetrade, the investment options are very restricted as you cannot invest in funds (only equities).

Fees can be collected via Direct Debit or from cash held in your account – if payment methods fail, holdings may be sold to cover outstanding fees which is general practice among investment platforms.

Interactive Investor ii SIPP Review

Interactive Investor’s SIPP is the UK’s largest flat-fee-based investing platform for SIPPs, offering a wide range of investment options and attractive benefits for pension investors.

Like most SIPPs, the platform provides investors with the flexibility to choose from various investment options, including shares, funds, investment trusts, bonds, and ETFs.

This allows you to create a diversified portfolio tailored to your investment goals and risk appetite.

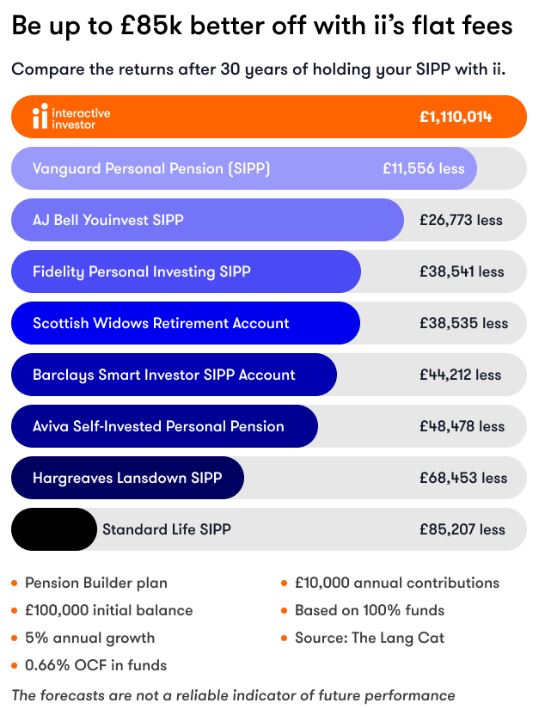

One of the key advantages of Interactive Investor’s SIPP is its low fees compared to many competitors in the market. The platform operates on a flat-fee structure, making it cost-effective for investors who trade frequently or hold a significant portfolio.

Additionally, Interactive Investor offers 24/7 customer support, ensuring that investors have access to assistance whenever they need it.

However, it’s important to note that Interactive Investor’s SIPP has a few drawbacks. The platform’s charting tools are limited, which might deter investors who rely heavily on technical analysis.

| Pros | Cons |

| Wide range of investment options | Limited charting tools |

| Low annual fees compared to competitors | Limited investor research and guides |

| 24/7 customer support |

Fees and Charges of Interactive Investor’s SIPP

It’s important to understand the fees and charges associated with Interactive Investor’s SIPP to evaluate its cost-effectiveness for your individual pension needs.

With a flat platform fee of £12.99 per month (and just £5.99 for portfolios under £50,000), it provides a straightforward and transparent pricing structure that is well-suited for both novice and experienced investors.

For perspective, if you pay 0.25% (a fairly competitive annual fee) on a SIPP worth £100,000, that’s £250 per year – already more expensive than ii’s £155.88 per year.

However, for very small portfolios is may be cheaper to go with another provider that has an annual percentage fee. For example, 0.25% of £10,000 is just £25 per year.

Share dealing also starts from a competitive £3.99 per trade, which is also attractive. However, this also applies to trading funds, which are free to trade with some other SIPP providers.

It’s also worth noting here that Freetrade’s SIPP is just £11.99 per month, so slightly cheaper, and there are no trading fees, but there’s no discount for smaller portfolios – so the cheapest will depend on your SIPP value, and the Freetrade SIPP has its own set of pros and cons (you can’t invest in funds).

So although ii’s £3.99 per trade is competitive in the market, It’s important to note that these trading fees can add up, especially for frequent traders, and may affect the overall profitability of your investments.

Also, while the platform provides a diverse range of investment opportunities, it’s essential to consider the associated costs that are separate to ii’s fees.

For example, funds and investment trusts have additional underlying fees that are taken from within your investments, which can impact your overall returns. It’s essential to consider your individual investment strategy and what types of assets you’ll hold in your SIPP, and check all the underlying costs behind each one when building your portfolio.

To compare Interactive Investor’s fees against other SIPP provider fees, use our calculator tool below to give you a rough idea.

SIPP Provider Fees Calculator

If you know roughly what assets your SIPP portfolio is going to consist of, you can enter the values into our SIPP fees calculator below to get a rough estimate of the annual fees each SIPP provider would charge you based on their fee structures.

It’s split between funds and equities because some providers charge different amounts for each asset class (this is worked into the calculator).

Note: The ongoing fees for your SIPP are only one type of SIPP charge, so are not the only factor to consider (although it is the most significant charge you’ll pay). Also, you should think about other SIPP features and benefits including customer service, and the user experience of the platform.

Interactive Investor’s SIPP Features and Services

Interactive Investor’s SIPP provides a comprehensive range of investment options, including shares, funds, investment trusts, bonds, and ETFs, allowing you to tailor your pension portfolio to your investment goals.

Whether you prefer to invest in individual companies or diversify your holdings through funds and trusts, Interactive Investor offers a wide selection to meet your needs.

In addition to the investment options, Interactive Investor’s SIPP comes with a range of features and services to enhance your investing experience. The platform offers reliable and user-friendly tools and resources, including research and analysis tools, market data, and educational materials to help you make informed investment decisions.

Also, they provide 24/7 customer support, so assistance is available whenever you need it. Whether you have a question about your account, need help navigating the platform, or require assistance with a specific investment, their knowledgeable support team is ready to help.

Interactive Investor’s SIPP Fees and Charges

| Fees | Charges |

| Annual account fee | £155.88 |

| Dealing charges | From £3.99 per trade |

| Transfer out fee | Free |

It is important to note that fees and charges can vary depending on your investment activity and the specific services you utilise. Always review the latest fee schedule provided by Interactive Investor to ensure you have the most accurate and up-to-date information.

Pros and Cons of Interactive Investor’s SIPP

While Interactive Investor’s SIPP offers low fees and a generous contribution limit, it also has limitations such as limited charting tools and potentially expensive trading fees.

One of the major advantages of Interactive Investor’s SIPP is its low fee structure. Compared to other SIPP providers in the market, Interactive Investor charges a flat fee rather than a percentage-based fee. This can be highly beneficial for investors with larger portfolios, as it allows them to save on fees and potentially increase their overall returns.

Comparison of II SIPP with Other Providers

To ensure you choose the best SIPP option for your pension needs, it’s good to compare the ii SIPP with other top providers, considering factors such as fees, investment options, and customer support.

We recommend reading our other SIPP reviews and comparing costs, fees, investment options, customer reviews and other aspects to get a good understanding as to what the best SIPP is for you.

FAQ

What investment options are available through Interactive Investor’s SIPP?

Interactive Investor’s SIPP offers a range of investment options, including shares, funds, investment trusts, bonds, and ETFs.

What is the contribution limit for Interactive Investor’s SIPP?

The SIPP has a generous contribution limit of up to 100% of your salary, with tax relief applied.

What types of accounts does Interactive Investor offer?

Interactive Investor offers different account types, such as Stocks and Shares ISAs, Trading Accounts, and Self-Invested Personal Pensions (SIPPs).

How are fees collected for Interactive Investor’s SIPP?

Fees can be collected via Direct Debit or from cash held in the account. If payment methods fail, holdings may be sold to cover outstanding fees.