While the best SIPP provider depends of a range of factors – from customer service, to investment choice, to the online account and app functionality – the fees and charges are often the bottom line that investors base their decisions on.

So while we look at all the above factors in this comparison, we really hone in on the charges to help you truly understand how much you’ll pay with different SIPP providers. Spoiler alert: there are some big variations depending on the provider you choose.

And, you can use our calculator below to see roughly how these charges compare side-by-side for each provider, based on your portfolio.

Remember, the fees you’ll pay for your SIPP depend on the makeup of your portfolio (i.e., the specific investments you hold within it), so it’s important to compare the charges based on your investment plan. Our calculator factors most of these variations in – but you should run your own calculations too before you decide to invest.

- The Best SIPP Providers

- SIPP Provider Fees Explained

- SIPP Provider Charges Compared - Calculator

- 1. InvestEngine SIPP: Best For New SIPP Accounts (And Cheapest)

- 2. Interactive Investor ii SIPP: Best Flat Fee Provider

- 3. Moneyfarm SIPP: A Strong Robo-Advice Contender

- 4. AJ Bell Youinvest SIPP: Best for Low Fees with a Smaller Pension Pot

- 5. Fidelity SIPP: Great for Beginners and Good All-Rounder

- 6. Vanguard SIPP: Overall Cheapest SIPP for Sub £30k Portfolios

- 7. Freetrade SIPP: Low Fees, but Only Shares

- 8. Hargreaves Lansdown SIPP: Best for Beginners

- 9. Nutmeg Pension: Robo-Adviser SIPP

- Factors to Consider When Comparing The Best SIPP Providers

- Navigating the Selection Process

- FAQ

The Best SIPP Providers

First thing’s first, here’s our list of the 9 best SIPP providers:

- InvestEngine SIPP: Best for new SIPP accounts. Invest in ETFs only, but is generally the cheapest SIPP for portfolios under £80,000. They also have the cheapest managed portfolio option.

- Interactive Investor SIPP: Best flat fee provider SIPP (typically £12.99 per month) and it has great investment options.

- Moneyfarm SIPP: Best robo-advice SIPP. Your investment portfolio is created and managed by experts at a low cost.

- AJ Bell Youinvest SIPP: Low fees and good for small pension pots – ongoing fee for funds starts at 0.25% per year but is tiered down to 0% after £500k, and only £10 per month for equities.

- Fidelity SIPP: Great for beginners but slightly more expensive – offers a wide range of investment options, including low-cost funds.

- Vanguard SIPP: Joint cheapest SIPP for portfolios under £80k (0.15% pa, capped at £375 per year) – but, investment options are limited to only Vanguard’s own funds, and becomes more expensive than InvestEngine at higher account values.

- Freetrade SIPP: Low fees for larger pension pots over £80k (fixed at just £11.99 per month) and great trading and FX fees, however, limited to equities only (no funds!)

- Hargreaves Lansdown SIPP: Best for beginners – great customer service, great app and online platform, and excellent research teams (but you pay for it with higher fees, unless you invest in equities only).

- Nutmeg SIPP: Alternative robo-advice portfolio option, similar to Moneyfarm.

Note that while these are 9 of the most well-known (and best, in our view) SIPPs on the market currently – there are in fact around 60 SIPP providers across the entire market, some of which are lesser-known, smaller in total assets under management, and are tailored to more niche types of investments and customers.

A note on the type of SIPP you’re opening:

If you’re opening a new SIPP, you might want to choose a provider with lots of investment choice and plenty of investing guides and support.

On the other hand, if you’re transferring an existing SIPP from one provider to another, you may just want to work out which provider charges you the least for your specific portfolio (assuming you’re keeping it as it is).

And finally, if the idea of choosing your own investments is too daunting, we recommend either getting SIPP advice (book a free consultation with our advisers), or investing in a ready-made SIPP portfolio that’s tailored to your risk profile. Both Moneyfarm and Nutmeg provide options on this – but more on that later.

We’ll go into more detail for each SIPP provider on our list; however, first, we think it’s important to clearly explain SIPP provider fees and how they work. Each provider charges slightly differently, and while our calculator accounts for most of these discrepancies, it’s really important to have a fundamental understanding of how the charges actually work.

SIPP Provider Fees Explained

While one SIPP provider may be the cheapest for one portfolio, a different portfolio made up of different assets (funds instead of shares, for example) might very well be cheaper with another provider.

It can also vary depending on how much you intend to trade within your SIPP, because some SIPPs have higher dealing charges than others, and even vary based on whether you’re trading funds (unit trusts, ETFs and OEICs) or equities (shares and investment trusts).

Here’s a list of the main SIPP fees and how they work:

1. SIPP Provider’s Annual Fee

This is the most expensive SIPP fee, so it’s generally the most important one. It’s the amount your SIPP provider charges for holding assets within a SIPP on their platform.

There are a few ways that SIPP providers charge this fee:

- As a percentage of your total portfolio

- As a percentage of your portfolio split between asset classes (e.g., no fee for holding shares or other equities, but 0.45% per year for funds). This is the most common set-up among providers.

- As a fixed, monthly amount

So, if your portfolio is made up of shares or investment trusts (these are traded in the same way as shares), it might be cheaper with one provider compared to if your portfolio is made up of funds.

Also, some providers offer a tiered fee structure, which means it reduces for account values over certain thresholds.

For example, you might pay 0.45% on the first £100k in your SIPP, 0.25% on the value between £100k and £500k, and then 0.1% on the value above £500k. In this way, the charge becomes more forgiving for high-value SIPPs, where a flat percentage would be punishing for larger portfolios.

2. Underlying Fund Charges

Underlying fund or portfolio charges don’t affect all types of investments, but they’re fairly significant for certain types, so they’re worth talking about.

Specifically, managed and passive funds, such as Unit Trusts and OEICs (Open Ended Investment Companies), commonly have an annual TER (Total Expense Ratio) or OFC (Ongoing Fund Charge).

You can find the ongoing fund charge of each fund you invest in by looking at the Key Investor Information Document (KIID) for each fund, and they usually range from 0.5% to 1%, with passive funds (not managed by professionals) being lower at around 0.1-0.3%.

ETFs (Exchange Traded Funds) tend to have lower charges as they just track an index, and there is little professional management involved, and Investment Trusts can also have ongoing charges attached to them similar to the managed funds mentioned above.

Finally, direct shares do not have any underlying charges.

We bring these charges up because some providers have negotiated lower ongoing fund charges for their customers with certain fund managers. For example, Hargreaves Lansdown negotiates discounts with many fund managers and uses this point as marketing for their SIPP, understandably – but, it’s only a benefit to you if you invest in those specific funds.

On the other hand, the Vanguard SIPP has a very low annual management fee of 0.15%, but you can only invest in their own funds – and these funds also have underlying funds charges to consider.

Trading Fees

The next most significant SIPP cost is the fees to buy and sell holdings. This will obviously be more significant if you’re looking to trade regularly, compared to having more of a ‘set and forget’ investment approach.

Some providers charge a flat fee for all trades, some take a percentage as commission, some give you discounts based on how many trades you make per month, and some charge for trading equities (shares, investment trusts and ETFs), but not for funds (OEICs and Unit Trusts), while some charge for both.

You’re usually charged more for buying stocks on foreign stock exchanges, too.

The cheapest SIPP for you in terms of dealing fees depends on:

- How often you trade

- What types of assets you’re buying and selling

- And the size of your trades

Drawdown, Transfer and Admin Fees

Finally, here’s a list of other fees to keep an eye out for. These are less significant, but worth checking before you open a SIPP:

- Annual admin fee (rarely seen, but can be in the region of £150 per year, for example)

- Account closure fee (typically around £50)

- Drawdown fee (for actually taking income from your SIPP)

- Transfer out fee (typically £50, but can be charged per line of stock transferred, which can quickly add up)

- Contribution fee (again, rarely seen but keep an eye out)

SIPP Provider Charges Compared – Calculator

If you know roughly what assets your SIPP portfolio is going to consist of, you can enter the values into our calculator below to get a rough estimate of the annual fees each SIPP provider would charge you based on their fee structures.

It’s split between funds and equities because some providers charge different amounts for each asset class (this is worked into the calculator).

As we mentioned earlier, the ongoing fees for your SIPP are only one type of SIPP charge, so are not the only factor to consider.

Additionally, some providers pool together the value of any other investment accounts you hold with them when calculating your charges, such as ISAs and GIAs, which may make those fees cheaper than what’s displayed in the calculator (if you do indeed have those other assets to factor in).

Also, you should of course think about other SIPP features and benefits, including customer service, platform usability, the research they provide etc. More on those aspects later…

So, now that we’ve broken down how the fees work and what to look out for, and compared the options, let’s look at some SIPP providers and how they charge specifically, as well as their other key features and benefits.

1. InvestEngine SIPP: Best For New SIPP Accounts (And Cheapest)

The InvestEngine SIPP was launched fairly recently in 2024, and offers what we think is the best SIPP option for new investors (i.e., if you’re setting up a brand new account, not transferring an existing SIPP).

With fees of just 0.15% per annum capped at £200 for the year, it’s the cheapest SIPP available for portfolios under £80,000.

The only real drawback of the InvestEngine SIPP is that you’re tied to investing in ETFs.

Now, ETFs are generally a very cost-effective investment choice: ETF stands for ‘Exchange Traded Fund’, and they essentially track a certain index or stock market for a very low cost. There is no ‘active management’ in the form of a professional fund manager picking stocks and getting paid to do so – they just automatically track an index, so the fees are minimal.

And by combining a mixture of ETFs (there are over 600 on the InvestEngine platform) you can create a very diversified portfolio with extremely low charges, both from your SIPP provider and your underlying investments.

You also get no dealing charges with InvestEngine, a great app and online account functionality, and really responsive customer service…

The managed portfolio option (robo-advice):

If you’re not confident in building your own portfolio, InvestEngine do offer a ‘built for you’ SIPP portfolio based on your risk profile and a few other questions (also referred to as robo-advice, or a managed portfolio). This is similar to Nutmeg and Moneyfarm mentioned later, although at a much lower cost of just 0.25% per annum.

If you’re looking for a low-cost SIPP but with the peace-of-mind that your investments are being looked after by professionals, it’s hard to argue that InvestEngine’s SIPP isn’t the best – in fact, their managed SIPP portfolio is cheaper than some DIY SIPPs on the market!

All in all, InvestEngine are fairly new to the SIPP market, but they’ve entered with a bang. And rest assured they’re FCA regulated and covered by the FSCS, like every other SIPP provier on this list.

If you’re opening a brand new SIPP, it’s hard to argue with InvestEngine’s offer – at least until your portfolio reaches £80k+, in which case you may be able to save on fees elsewhere (but not a huge amount!).

They also currently have an offer running to win up to £50 for opening a SIPP via a partner like us, and you can then refer friends to earn more (Ts&Cs apply):

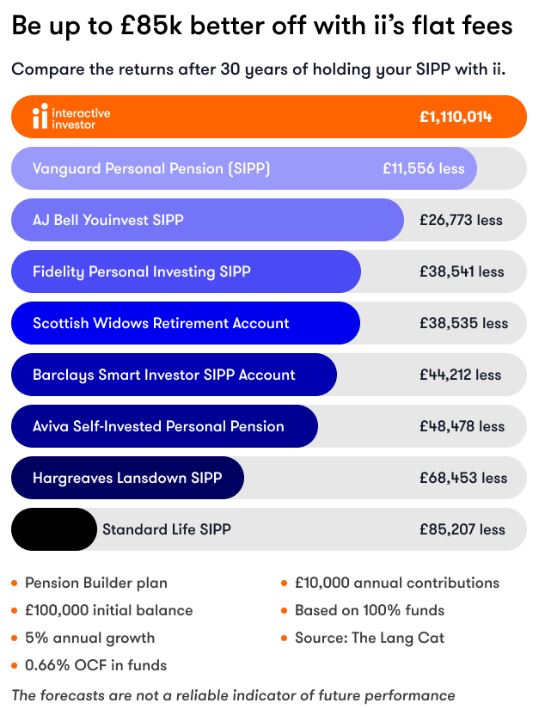

2. Interactive Investor ii SIPP: Best Flat Fee Provider

The Interactive Investor SIPP (ii SIPP) the best flat fee SIPP provider for us, offering versatility and predictable costs, with a wide range of investment options.

With a flat platform fee of £12.99 per month (and just £5.99 for portfolios under £50,000), it provides a straightforward and transparent pricing structure that is well-suited for both novice and experienced investors.

For perspective, if you pay 0.25% (a fairly competitive annual fee) on a SIPP worth £100,000, that’s £250 per year – already more expensive than ii’s £155.88 per year.

However, for very small portfolios it may be cheaper to go with another provider that has an annual percentage fee. For example, 0.25% of £10,000 is just £25 per year. Using our calculator above is the best way to compare these.

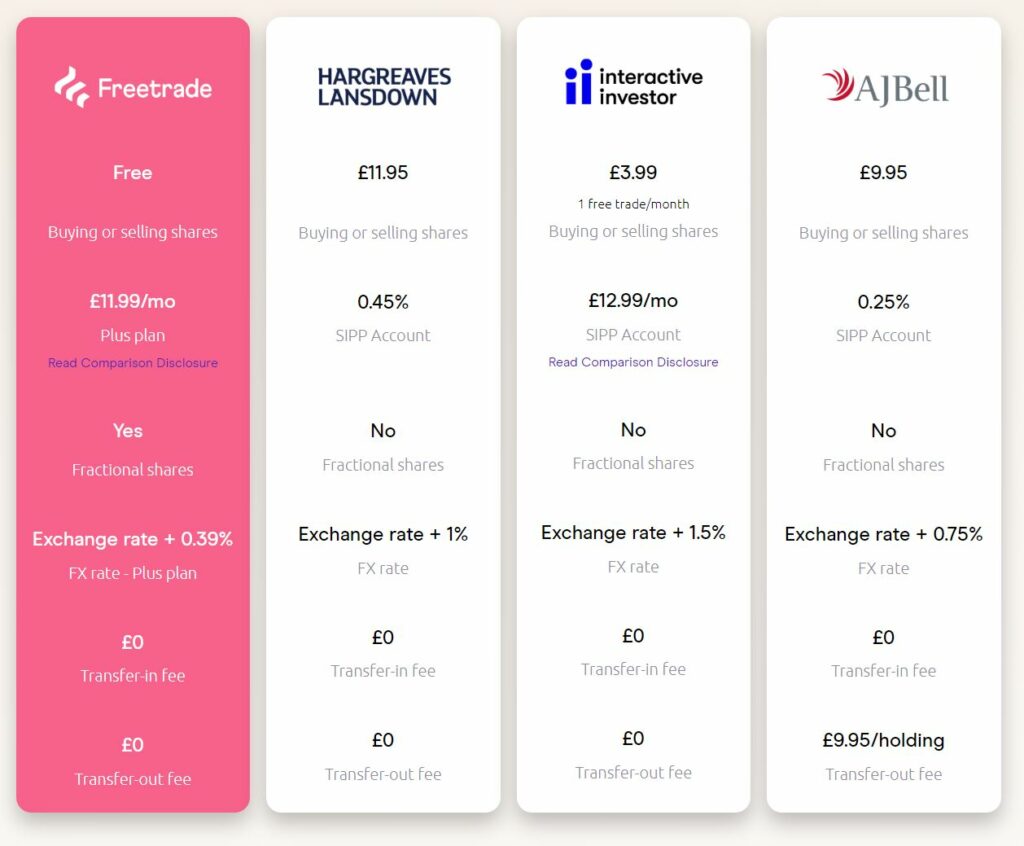

Share dealing also starts from a competitive £3.99 per trade, which is also attractive. However, this also applies to trading funds, which are free to trade with some other SIPP providers.

It’s also worth noting here that Freetrade’s SIPP is just £11.99 per month and there are no trading fees, but there’s no discount for smaller portfolios – so the cheapest will depend on your SIPP value, and also the Freetrade SIPP has its own set of pros and cons (you can’t invest in funds).

One of the key strengths of the Interactive Investor SIPP is its extensive range of investment options. From shares and funds to investment trusts and ETFs, you’ll have access to a diverse selection of assets to build a well-rounded portfolio. Whether you prefer a hands-on approach or want to utilise their ready-made portfolios, it offers flexibility to cater to your investment objectives.

They also offer a user-friendly online platform that allows you to easily manage your pension investments. It provides real-time portfolio information, interactive charts, and tools to help you make informed investment decisions. The platform is designed to be intuitive and accessible, even for those who are new to SIPPs.

A few other points:

- International trades cost £9.99

- Their FX fees range from 0.25% to 1.5% depending on the value of the trade – nothing special

Read our full ii SIPP review »

Key Highlights of the Interactive Investor SIPP

| Key Highlights | Details |

| Versatile Investment Options | A wide range of assets including shares, funds, investment trusts, and ETFs |

| Predictable and Low Flat Fee | £12.99 per month max cost, allowing you to plan your costs more effectively |

| User-Friendly Platform | Enables easy management of your SIPP investments with interactive tools and real-time information |

3. Moneyfarm SIPP: A Strong Robo-Advice Contender

Moneyfarm’s SIPP is a good all-round robo-advice SIPP.

It’s great for those seeking a ‘hands-off’ approach to retirement savings. You get investment advice tailored to your risks levels and preferences along with an actively managed portfolio, with much cheaper costs compared to using a traditional financial advisor.

Their fee structure is competitive for this type of service, starting at 0.75% and reducing to 0.25% for larger portfolios.

The investment options for Moneyfarm SIPP include:

Active Management: This involves a smart technology-driven process to create an investor profile, match with a globally diversified portfolio, and manage investments with strategic adjustments and regular rebalancing. Charges start from 0.75%, reducing to 0.35% for portfolios over £500k.

Fixed Allocation: Similar in setup to active management, but with a passive investment approach and less frequent rebalancing. Fees for this option are lower, starting at 0.45% and reducing to 0.25% for larger portfolios.

ESG (Ethical Investing): Offers socially responsible portfolios focusing on environmental, social, and corporate governance factors.

Moneyfarm also provides access to personal investment consultants for regulated advice and assistance with investment selections and portfolio performance. We think this represents excellent value for money compared to other options on the market.

It has garnered a positive reputation in the industry, with over 125,000 customers and £3.5 billion in managed funds. However, it does have a minimum investment requirement of £500.

Read our full Moneyfarm pension review »

4. AJ Bell Youinvest SIPP: Best for Low Fees with a Smaller Pension Pot

The AJ Bell Youinvest SIPP is recognised as often being the best option for those with smaller pension pots, offering a lean fee structure and a user-friendly interface.

When it comes to fees, AJ Bell Youinvest offers a tiered pricing structure based on the value of your pension pot.

For pension pots under £250,000, the annual charge is a low 0.25%, ensuring that you can keep more of your hard-earned savings invested.

This is tiered and reduces to 0.1% for your balance over £250,000, and there’s no charge for your balance over £500,000. This is also just for funds – for shares (including ETFs, investment trusts etc.), it’s a flat 0.25% but capped at £10 per month for those assets.

When compared to Interactive Investor’s charging structure, it breaks even with the monthly fee of £5.99 (only applicable to SIPPs under £50,000) at the portfolio range of about £30,000. Anything over this amount and you’ll still likely save money with an ii SIPP or Freetrade SIPP (not to say they’re the best option still).

In addition to its low fees, AJ Bell Youinvest also provides a user-friendly platform, making it easy for individuals to manage their investments. The platform offers a wide range of investment options, including a variety of funds and shares, giving you the flexibility to tailor your portfolio to your specific investment goals.

Table: Comparison of SIPP Providers for Smaller Pension Pots

| SIPP Provider | Annual Charge | Platform Fees | Investment Options |

| AJ Bell Youinvest SIPP | 0.25% | Tiered | Wide range of funds and shares |

| Interactive Investor SIPP | £12.99 per month | Flat fee | Wide range of funds and shares |

Source: Data compiled from official SIPP provider websites as of [13/10/2023]. Please note that fees and features are subject to change. It is advised to visit the respective provider’s website for the most up-to-date information.

A few extra points to note:

- Share dealing costs £9.95 which is fairly expensive, but this reduces to £4.95 for frequent traders and funds only cost £1.50 per trade

- Their FX fees are also competitive, ranging between 0.25% to 0.75%, and better than Interactive Investors

Read our full AJ Bell SIPP review »

5. Fidelity SIPP: Great for Beginners and Good All-Rounder

Fidelity is a well-respected name in the investing industry, and they have the customer service reputation, industry-leading research and a superior platform to back that up – but, their SIPP is more expensive.

At 0.35% per year for annual fees, the charges are higher than AJ Bell and most ii SIPP portfolios – but they’re still competitive and fees aren’t everything.

It’s also a tiered fee structure, so balances over £250,000 are charged at 0.2%, and there’s no charge for holdings over £1m.

In terms of trading fees, it’s a flat £7.50 for shares and no charge for trading funds – not too shabby at all.

Their FX are also 0.25-0.75% – another competitive price.

One of the key advantages of the Fidelity SIPP is its diverse range of investment options. You’ll have access to a wide selection of funds, including low-cost index trackers and actively managed funds from renowned fund managers. This allows you to create a well-diversified portfolio that aligns with your investment goals.

Additionally, Fidelity offers a user-friendly online platform that makes it easy to manage your investments. You can view your portfolio, track performance, and make trades at your convenience. The platform also provides comprehensive research and educational resources to help you make informed investment decisions.

| Key Highlights of Fidelity SIPP: |

| Low minimum deposit requirement |

| Competitive but not the lowest fees |

| Strong customer service track record |

| Diverse range of investment options |

| User-friendly online platform with excellent research and educational resources |

Read our full Fidelity SIPP review »

6. Vanguard SIPP: Overall Cheapest SIPP for Sub £30k Portfolios

For those seeking the overall cheapest SIPP for portfolios under £100k, it’s most likely to be the Vanguard SIPP, known for its competitively priced funds, although with some limitations on investment options. You can only invest in Vanguard’s own funds in their SIPP.

The annual charge is just 0.15%, meaning on a £100k SIPP portfolio that’s just £150 per year.

It’s also hard-capped at £375 per year, so even for large SIPP portfolios this is still very competitive (the fees effectively max out at £250k invested). Also it’s important to note, this £250k cap is across all your Vanguard investment accounts. So if you also have ISAs and a GIA (General Investment Account), it might be even more cost-effective.

But the big limitation is investment choice. While Vanguard’s funds are renowned in the industry and are cheap themselves (with a focus on low-cost index funds they average at just a 0.2% underlying fund charge), you are limited to one fund manager.

Whether this is a problem for you depends on your investment plan – and if you need help, we recommend speaking to an adviser.

They do offer transparent and competitive pricing for their funds, and there is no charge for trading funds, which is a nice plus.

| Key Features of Vanguard SIPP: |

| Competitively priced funds |

| Low-cost index funds |

| Transparent, low and predictable fee structure |

| Limited investment options |

Remember, while cost is an important factor to consider, it shouldn’t be the sole criterion for choosing a SIPP provider. Make sure to evaluate other aspects like customer service, investment options, and user experience before making a decision.

Read our full Vanguard SIPP review »

7. Freetrade SIPP: Low Fees, but Only Shares

Individuals with larger pension pots benefit from the Freetrade SIPP, which offers arguably the best fee structure for high value SIPPs. But the drawback is only being able to invest in equities (i.e., shares, investment trusts, bonds, ETFs etc.)

Equities can be higher risk than funds, especially direct shares, and it leaves you with less investment choice. However you can still invest in ETFs and some investment trusts, which do allow for plenty of diversification.

Their research and guides are also focused on trading and stock-picking too, which isn’t necessarily the best investment technique for long-term pension savings (but it depends on your goals, risk tolerance and preferences etc.).

With the Freetrade SIPP, there is a fixed monthly fee of £11.99 per month for the plus plan, which is just £143.88 per year – very cheap for any portfolio over about £100.000.

There are also no trading fees, which is a huge plus.

And the FX fees only 0.39% plus the exchange rate, which is the best out of all the SIPP providers compared, so if you’re looking to build a portfolio of international stocks, this could be the best option.

Key Features of Freetrade SIPP:

- Transparent and competitive fee structure

- Low FX fees

- User-friendly platform for easy investment management

- Good range of investment options including stocks, ETFs, and investment trusts, but no funds

- Access to market insights and research tools

Reminder: When comparing SIPP providers, it’s crucial to consider your own investment objectives and financial situation, and seek financial advice if you’re unsure.

Read our full Freetrade SIPP review »

| SIPP Provider | Annual Fee | Additional Charges | Investment Options |

| Interactive Investor SIPP | £155.88 | Trading charges apply | Wide range, including shares, funds, and investment trusts |

| Freetrade SIPP | £143.88 | No trading charges | Limited to equities including investment trusts, ETFs, bonds and shares |

| AJ Bell Youinvest SIPP | 0.25% (max £120 per year) | Trading charges apply | Wide range, including shares, funds, and investment trusts |

| Fidelity SIPP | £0.35% (tiered) | Trading charges apply | Wide range, including shares, funds, and investment trusts |

| Vanguard SIPP | 0.15% (capped at £375 per year) | No trading charges | Limited to Vanguard’s own funds |

| Hargreaves Lansdown Vantage SIPP | Starts at 0.45% per annum (tiered) | Trading charges apply | Wide range, including shares, funds, and investment trusts |

| Nutmeg Pension | 0.75% | No additional charges | Robo-adviser service with diversified portfolios |

InvestEngine | 0.15% (capped at £200 per year) | No trading charges | ETFs only |

Remember, choosing the right SIPP provider is crucial for the growth of your pension funds. Do your research, compare fees and charges, and consider factors like investment options, customer service, and ease of use.

8. Hargreaves Lansdown SIPP: Best for Beginners

When it comes to customer service, the Hargreaves Lansdown Vantage SIPP stands out, consistently excelling in delivering top-notch support, as evidenced by numerous awards.

With a reputation for providing exceptional service, Hargreaves Lansdown goes above and beyond to ensure their customers have a positive experience throughout their SIPP journey.

This is thanks to their dedicated client support team. They have a team of knowledgeable and friendly professionals who are readily available to assist clients with any queries or concerns they may have – this goes for SIPP rules and regulations as well as investment choices and trading logistics.

Whether you need help with setting up your SIPP, understanding investment options, or navigating the platform, Hargreaves Lansdown’s customer service team is always just a phone call away – and they have brilliantly low wait times.

In addition, Hargreaves Lansdown also provides a wealth of educational resources and tools to help investors make informed decisions. Their website is filled with informative articles, guides, and videos that cover a wide range of topics related to investing and retirement planning. They invest heavily in their guides, research and content – which is a plus for investors.

They also offer regular webinars and seminars to help investors stay up to date with the latest trends and developments in the market. And finally they also offer a range of managed and ready-made portfolios to help less-confident investors that don’t want to pay for full-blown SIPP advice.

The drawback of a HL SIPP is higher fees, starting at 0.45% of your portfolio per annum. You do pay for the customer service and research you’re getting. But when it comes to pensions, this support is extremely valuable, so they’re definitely worth considering.

However, it’s worth noting that for holding equities (ETFs, share etc.,) their fees are actually very competitive as they’re capped at £200 per year. So if you’re investing in an ETF portfolio, for example, HL is still a very cheap option.

The fee structure for holding funds:

- 0.45% on the first £250,000

- 0.25% on £250,000 to £1m

- 0.1% on values between £1m and £2m

- No charge over £2m

For shares, it’s a similar 0.45% but these assets are capped at costing you £200 per year (about the value of £45,000 in shares).

As for trading fees, it’s free to trade funds, which is great.

Share trades cost £11.95, with discounts available for frequent traders – not the best, but competitive.

| Key Highlights of Hargreaves Lansdown Vantage SIPP: |

| Consistently top-rated for customer service |

| Dedicated client support team |

| Comprehensive educational resources and tools |

| Regular webinars and seminars |

| Great investment options |

| Higher fees |

When choosing a SIPP provider, it’s crucial to consider not only the investment options and fees but also the level of customer service. With Hargreaves Lansdown Vantage SIPP, you can have peace of mind knowing that you’ll receive exceptional support and guidance every step of the way.

Read our full Hargreaves Lansdown SIPP review »

9. Nutmeg Pension: Robo-Adviser SIPP

The Nutmeg Pension is widely regarded as the best robo-adviser SIPP, offering a user-friendly platform and competitive fees for those looking for a hands-off investment experience.

With a Nutmeg Pension, you can enjoy the benefits of automated investment management while maintaining control over your pension. The platform provides a clear overview of your investments, allowing you to track your progress and make informed decisions.

Competitive fees are another standout feature of the Nutmeg Pension in comparison to other robo-advice SIPPs and managed or ready-made portfolios with other SIPPs. However, they can be notably higher than if you build your own SIPP with another provider, especially for larger portfolios.

Nutmeg offers a tiered fee structure based on the size of your portfolio, and the fees vary depending on the type of investment option you choose.

The cheapest fee option is their Fixed Allocation portfolio:

| Portfolio Size | Annual Management Fee |

| Up to £100,000 | 0.45% |

| £100,001 and above | 0.25% |

Here’s a more detailed breakdown that includes the underlying fund charges:

By offering a wide range of portfolio options, a user-friendly platform, and competitive fees, the Nutmeg Pension stands out as the best robo-adviser SIPP. It’s a great choice for those who prefer a hands-off approach to investing and want to maximise their pension growth with the help of technology-driven portfolio management.

But keep in mind, you’ll probably be paying more than if you create your SIPP portfolio yourself. This is especially true for larger portfolios, because there is no cap to the annual fee.

Factors to Consider When Comparing The Best SIPP Providers

Choosing the best SIPP provider requires careful consideration of several factors, such as annual admin fees, fund dealing fees, share dealing fees, and other charges.

These fees can significantly impact the overall performance and growth of your pension pot, so it’s important to compare them across different providers before making a decision.

When evaluating annual fees, look for a provider that offers competitive rates without compromising on the quality of service. Some providers may charge a fixed fee, while others charge a percentage of your pension value. Consider your pension size and investment strategy to determine which fee structure is more suitable for your needs.

In addition to admin fees, fund dealing fees and share dealing fees are also important to consider. These fees can vary greatly between providers, and they can have a significant impact on your investment returns. But it also depends how often you will be trading in your portfolio. If you’re going with a ‘set and forget’ long term SIPP investment strategy, this won’t affect you much. But if you’re trading regularly and adjusting your portfolio, it’s more of a consideration.

Look for providers that offer a wide range of investment options with low dealing fees, especially if you plan to trade frequently or invest in specific funds or shares.

Other charges

Aside from the main fees, it’s also important to consider any additional charges that may apply. Some providers may charge for services like transferring your pension from another provider, accessing pension drawdown options, or receiving financial advice (if you want it). Make sure to review the fine print and understand all the potential charges you may encounter while using the SIPP provider.

Navigating the Selection Process

With several top-rated providers to choose from, it’s essential to consider certain factors before making a decision. Remember, your SIPP plays a crucial role in securing your retirement income, so taking the time to find the most suitable provider is paramount.

Things to Consider:

- Charges: Compare the annual admin fees, fund dealing fees, share dealing fees, and any other charges among various providers. Take note of any additional costs that may be imposed, such as inactivity fees or transfer fees.

- Investment Options: Assess the range of investment options available, such as stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Consider whether the provider offers a diverse selection to align with your investment goals.

- Customer Service: Research the provider’s reputation for customer service. Look for indicators like awards, reviews, and personal recommendations to gauge their level of support and assistance.

- Platform Interface: Evaluate the user-friendliness and functionality of the provider’s platform. A well-designed interface can make it easier to manage your investments and stay updated on your portfolio’s performance.

- Minimum Deposit: Consider the minimum deposit required to start a SIPP with each provider. This may vary significantly, so ensure it aligns with your initial investment capacity.

Don’t forget to read our full reviews of each SIPP compared in this article.

FAQ

What factors should I consider when choosing a SIPP provider?

When choosing a SIPP provider, it’s important to consider factors like charges, investment options, and customer service.

Which SIPP provider offers a wide range of investment options with a flat fee?

The Interactive Investor SIPP offers a massive range of investment options with a flat platform fee of £12.99 per month.

Which SIPP provider has the lowest minimum deposit?

Fidelity SIPP has a low minimum deposit requirement and offers a wide range of investment options.

Which SIPP provider is known for its competitive fees?

Vanguard SIPP offers competitively priced funds, though investment options are limited.

Which SIPP provider excels in customer service?

Hargreaves Lansdown Vantage SIPP is known for its excellent customer service and support.

Which SIPP provider offers a user-friendly robo-adviser service?

Moneyfarm offers a hands-off approach with a user-friendly platform and competitive fees.